Why I Treat Liability Insurance Like a Stealth Investment—And You Should Too

What if the thing protecting you from lawsuits was also quietly boosting your financial strategy? I used to see liability insurance as just another bill—until I faced a near-miss claim that could’ve wiped me out. That’s when it hit me: this isn’t just safety netting, it’s a strategic move. Let me walk you through how I started viewing liability coverage not as an expense, but as a smart, under-the-radar investment tool that safeguards everything I’ve built. It didn’t generate returns like a stock, but it preserved what I had—something no dividend can do when you’re staring down a six-figure legal claim. This shift in mindset didn’t come from theory; it came from fear, relief, and ultimately, clarity.

The Moment Everything Changed: How a Close Call Exposed My Blind Spot

A few years ago, a delivery driver slipped on my front steps during a light rain. It was a small incident—no broken bones, just a bruised hip and a complaint. I thought it would end with an apology and maybe a fruit basket. But weeks later, I received a letter from a law firm. The claim? Permanent back strain, lost wages, emotional distress. The demand? Over $125,000. Panic set in. My savings, my retirement accounts, the home I’d worked decades to pay off—everything felt suddenly exposed. I had homeowners insurance, but I didn’t fully understand the liability portion until my agent calmly explained: my policy would cover legal defense and any settlement, up to the limit. The claim was eventually dropped, but not before I spent sleepless nights wondering what would have happened if it hadn’t been.

That experience changed how I view financial security. Before, I measured success by portfolio growth, savings rates, and smart budgeting. I tracked my net worth quarterly and celebrated when it crossed milestones. But I hadn’t accounted for a single event—something outside my control—that could erase years of disciplined saving. The reality is, most people don’t think about liability until it hits them. They assume, ‘I’m careful. Nothing bad will happen.’ But liability isn’t about guilt or negligence—it’s about exposure. And in today’s litigious environment, even a minor accident on your property can become a major financial threat. My close call wasn’t just a warning; it was a wake-up call that risk protection is not a sidebar to wealth building—it’s central to it.

What struck me most was how quickly the situation escalated. I wasn’t accused of wrongdoing, yet the legal process alone was overwhelming. The insurance company assigned me an attorney, handled communications, and ultimately deflected the claim. Without that support, I would have had to hire a lawyer out of pocket, likely costing thousands before any settlement discussion even began. And if the claim had succeeded? I might have been forced to liquidate investments, dip into retirement funds, or even sell my home. That’s when I realized: liability insurance isn’t just about covering damages. It’s about protecting your entire financial ecosystem from collapse. It’s not flashy, and it doesn’t show up on a balance sheet as an asset, but its absence could destroy every asset you do have.

Beyond Payouts: Why Liability Insurance Is a Hidden Financial Strategy

Most people see insurance as a necessary cost—something they pay for but hope never to use. Health insurance, car insurance, homeowners insurance—they’re all expenses on the budget sheet. But what if we reframed liability coverage not as an expense, but as a form of financial defense? Unlike stocks or real estate, it doesn’t appreciate. Unlike a savings account, it doesn’t earn interest. But it does something equally important: it prevents catastrophic loss. Think of it like a seatbelt. You don’t wear it because you expect to crash; you wear it because if you do, it could save your life. Liability insurance works the same way—it’s not about the likelihood of a claim, but the severity of the consequence if one occurs.

The real danger isn’t the claim itself—it’s what happens if you’re underinsured. Imagine you’re found liable for a serious injury on your property. The court awards a $750,000 judgment. Your homeowners policy covers $300,000 in liability. That leaves $450,000 coming out of your pocket. Where does that money come from? You can’t just write a check. You’d have to sell assets—maybe your investment portfolio, your vacation home, or even your primary residence. Forced liquidation under pressure means selling at the worst possible time, often at a loss. You might trigger capital gains taxes, break long-term investment strategies, and undo years of disciplined saving. The financial ripple effects could last a decade.

Now contrast that with someone who has adequate liability coverage—say, through an umbrella policy. That same $750,000 claim is fully covered. Their assets remain untouched. Their investments continue to grow. Their peace of mind stays intact. The difference isn’t in their behavior or lifestyle—it’s in their protection strategy. This is where liability insurance shifts from cost to strategy. It’s not generating wealth, but it’s preserving it. And in wealth management, preservation is just as critical as growth. In fact, losing half your net worth in a lawsuit takes far less time than building it back. That’s why smart financial planning doesn’t stop at investing—it includes robust risk mitigation. Liability coverage isn’t the star of the portfolio; it’s the guardrail keeping everything else on the road.

The Ripple Effect: How One Claim Can Derail Years of Growth

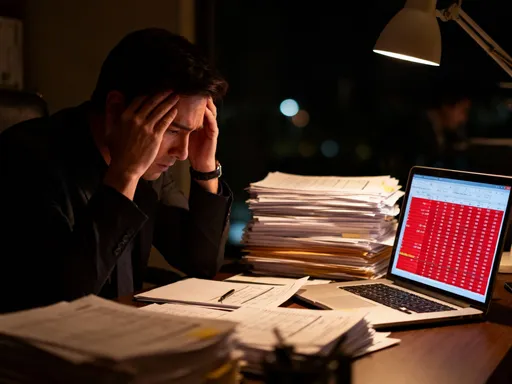

To understand the true cost of being underinsured, consider a hypothetical but realistic scenario. Meet Sarah, a 45-year-old mother of two, married, with a stable income and a growing investment portfolio. She owns her home, has $400,000 in retirement accounts, and is on track to retire comfortably by 65. She’s diligent about saving, maxing out her 401(k), and avoiding unnecessary debt. But she doesn’t have an umbrella policy. Her homeowners insurance includes $300,000 in liability coverage—standard, but not exceptional.

One weekend, her teenage son hosts a small gathering in the backyard. A guest slips near the pool, hits his head, and suffers a traumatic brain injury. The family sues. After legal battles, a court awards $1.2 million in damages. Sarah’s homeowners policy covers $300,000. The remaining $900,000 is her responsibility. With no umbrella policy, she must pay the balance. To do so, she liquidates her entire brokerage account—$250,000. She takes a $400,000 loan against her home. She withdraws $200,000 from her 401(k), incurring taxes and penalties. The final $50,000 comes from selling her husband’s classic car collection, a cherished hobby and minor investment.

The immediate financial toll is severe, but the long-term consequences are worse. By withdrawing from her 401(k), she not only loses the principal but also the decades of compounding growth that money would have generated. That $200,000, if left invested, could have grown to over $1 million by retirement. Now, it’s gone. Her home equity is drastically reduced, limiting future borrowing power or downsizing options. Her investment timeline is broken. She must delay retirement, possibly work into her 70s, and live more frugally than planned. All of this stems from one incident—one that wasn’t even her fault in a moral sense, but for which she was financially liable.

This is the invisible cost of liability risk: it’s not just the judgment amount, but the chain reaction it triggers. Emergency withdrawals, broken compounding, emotional stress, career disruptions, and family strain. Most people focus on the headline number—the $1.2 million claim—but the real damage is in the aftermath. That’s why liability protection isn’t an optional add-on. It’s a foundational layer of financial planning. Without it, your entire strategy is vulnerable to a single event. And in a world where lawsuits are common and settlements are large, assuming ‘it won’t happen to me’ is not optimism—it’s financial recklessness.

Choosing the Right Shields: Tools That Work Without Overpaying

So how do you build proper protection without overspending? The key is strategic layering—not over-insuring, but covering critical gaps. Start with your existing policies. Most homeowners and auto insurance plans include liability coverage, but the limits are often too low for today’s legal climate. A $300,000 liability limit might have been sufficient two decades ago, but now, medical costs, legal fees, and jury awards have risen dramatically. A single serious injury claim can easily exceed that amount. That’s where supplemental tools come in.

The most effective is the umbrella policy. Think of it as a financial firewall. It sits ‘on top’ of your existing coverage and kicks in when your primary policy limits are exhausted. For example, if your homeowners policy covers $300,000 and you face a $1 million claim, the umbrella covers the remaining $700,000. Premiums are surprisingly affordable—often $150 to $300 per year for $1 million in coverage. That’s less than $1 per day to protect hundreds of thousands in assets. For many families, it’s one of the highest-value financial moves they can make.

But an umbrella policy isn’t standalone. It requires underlying liability coverage on your home and auto policies. Insurers call this ‘qualified coverage’—you can’t buy an umbrella without meeting minimum liability limits on your base policies. So the first step is reviewing your current policies. Ask your agent: What’s my liability limit? Is it enough for my net worth and lifestyle? Could a claim exceed this? If not, consider increasing the limit. Some insurers offer endorsements—riders that boost liability coverage without a full policy overhaul. These can be cost-effective for moderate increases.

It’s also important to avoid over-insuring. You don’t need $5 million in coverage if your net worth is $500,000. Match your protection to your exposure. But err on the side of caution. If you have a pool, a trampoline, a dog breed considered high-risk, or teenagers who drive, your liability risk increases. If you host frequent guests, rent out part of your home, or coach youth sports, you’re exposed to more potential claims. These aren’t reasons to stop living fully—they’re reasons to protect wisely. The goal isn’t to eliminate risk (impossible) but to manage it intelligently. And that means choosing tools that offer maximum protection at reasonable cost, not cutting corners to save a few dollars a month.

The Math of Safety: Balancing Premiums and Potential Losses

At its core, liability insurance is about cost-benefit analysis. You pay a small, predictable amount today to avoid a potentially massive, unpredictable loss tomorrow. It’s not about hoping to ‘break even’—you don’t buy insurance expecting to collect more than you pay in premiums. You buy it because the alternative is unacceptable. Consider two individuals: Jane and Lisa. Both are 42, own homes, have similar incomes, and invest regularly. Jane skips extra liability coverage to save money. She pays $600 a year for basic homeowners and auto insurance with standard liability limits. Lisa spends an additional $250 a year—$20.83 per month—for a $1 million umbrella policy.

For years, Jane feels smart. She’s saving $250 annually. Lisa is ‘wasting’ money on something she may never use. Then, Jane’s dog bites a neighbor’s child during a walk. The injury requires surgery and therapy. The family sues. The final judgment: $620,000. Jane’s homeowners policy covers $300,000. She must pay the remaining $320,000. She sells investments, takes a home equity loan, and depletes her emergency fund. Her financial plan is derailed. Lisa, in a similar situation, files a claim. Her umbrella policy covers the excess. Her assets remain intact. She pays nothing out of pocket.

Now look at the math. Jane ‘saved’ $250 a year for, say, 10 years—$2,500 total. But one event costs her $320,000. That’s a 12,700% loss on her ‘savings.’ Lisa paid $2,500 over the same period and avoided financial ruin. Her return isn’t in dollars gained, but in dollars preserved. This isn’t speculation—it’s risk management. And it mirrors investment principles: diversification reduces exposure to any single point of failure. An umbrella policy diversifies your financial risk. It doesn’t guarantee you’ll never face a claim, but it ensures you won’t face it alone.

The premium for liability protection is trivial compared to the stakes. For less than the cost of a weekly coffee, you can shield your life’s work from a single lawsuit. That’s not an expense—that’s leverage. You’re using a small amount of capital to protect a much larger amount. In investing, we celebrate leverage when it amplifies gains. We should respect it just as much when it prevents losses. After all, avoiding a $500,000 loss is financially equivalent to earning $500,000—without the taxes, effort, or time.

Integration: Making Liability Protection Part of Your Investment Routine

Once I understood the role of liability insurance, I stopped treating it as a separate chore. Instead, I integrated it into my financial routine—just like checking my investment performance, rebalancing my portfolio, or adjusting my budget. I now review my coverage every time I make a major financial decision. Bought a new car? I reassess auto liability. Increased my savings? I consider whether my umbrella limit still matches my net worth. Started a side business from home? I check if my homeowners policy covers business-related claims (most don’t). These aren’t one-time decisions—they’re ongoing adjustments.

I also coordinate coverage across policies. My home, auto, and umbrella policies are aligned so there are no gaps. I ensure my liability limits are consistent and sufficient. I keep records of all policies, renewal dates, and contact information for my agents. I’ve even added a line item in my annual financial review checklist: ‘Confirm liability coverage adequacy.’ It sits alongside ‘Review retirement contributions’ and ‘Evaluate investment fees.’ This may sound excessive, but so is ignoring fire alarms because you’ve never had a fire.

The goal is proactive, not reactive, protection. Too many people only think about insurance after a loss—when it’s too late. By building it into my financial rhythm, I ensure it’s never overlooked. I treat it with the same seriousness as tax planning or estate preparation. It’s not glamorous, but neither is losing everything. And just as I wouldn’t skip a routine health checkup, I don’t skip a coverage review. Both are preventive measures—small actions that prevent large crises.

Mindset Shift: From Expense to Essential Investment Infrastructure

Looking back, the biggest change wasn’t in my policies—it was in my mindset. I used to see liability insurance as a cost, something to minimize. Now I see it as infrastructure—like the foundation of a house or the firewall on a computer. You don’t see it every day, but without it, everything else is at risk. It doesn’t generate excitement or returns, but it enables everything that does. No one builds a mansion on sand. Why build a financial future on unprotected assets?

This shift has made me a more thoughtful investor. I no longer measure financial health solely by growth. I also measure it by resilience. How much can I lose in a worst-case scenario? What’s my recovery time? These questions are just as important as ‘What’s my rate of return?’ Because true wealth isn’t just about accumulation—it’s about sustainability. And sustainability requires defense, not just offense.

If you’re a parent, a homeowner, or someone who’s worked hard to build stability, your greatest asset isn’t your portfolio—it’s your ability to keep building. Liability insurance protects that ability. It’s not a get-rich-quick scheme. It’s a stay-rich strategy. It’s the silent partner in your financial journey—one that speaks up only when you need it most. So stop seeing it as an expense. Start seeing it as essential infrastructure. Review your coverage. Ask questions. Make adjustments. Because the best investment you can make isn’t always the one that grows your wealth—it’s the one that keeps it from vanishing overnight.